Full Tort vs. Limited Tort: Can You Sue in PA With Limited Tort?

When shopping for car insurance, there are so many things to consider that it may feel overwhelming. For instance, do you opt for liability only or full coverage? What about add-ons like full tort or limited tort — and what are the differences between the two? And how can a car accident attorney help explain your coverage?

We all want to be as protected as possible while still having manageable monthly premiums. To help you make the best decision for your family, we’re sharing everything there is to know about limited tort vs. full tort insurance.

Full Tort vs. Limited Tort: Explained

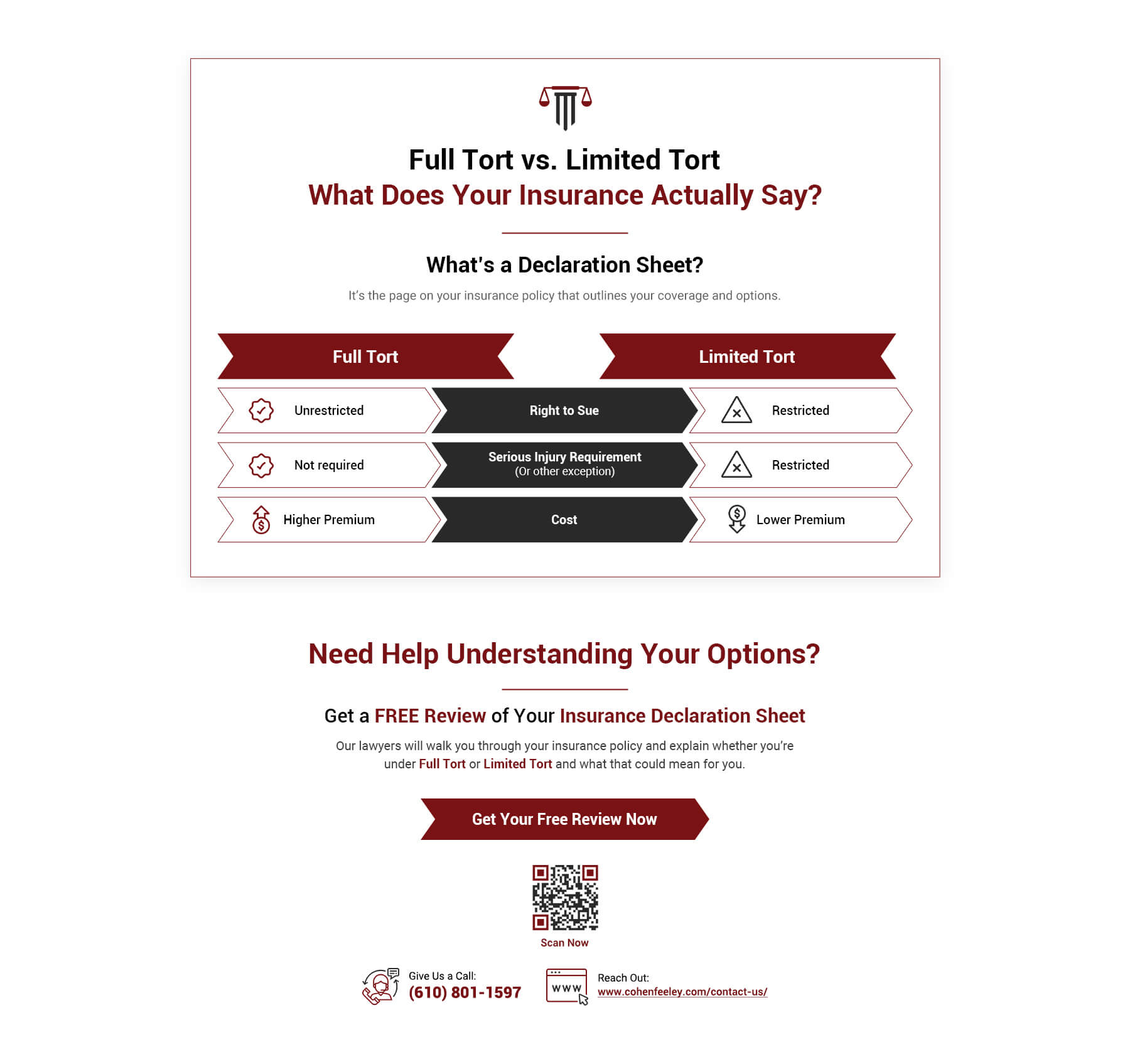

Full tort and limited tort address which types of damages you are able to recover and under what circumstances you are able to recover them. There are a few key differences to be aware of to choose the right policy for your family.

Let’s get into the full tort vs. limited tort debate:

What Is Full Tort?

Full tort is an option available in Pennsylvania as part of auto insurance policies. It allows policyholders to retain their unrestricted right to sue for damages following a car accident.

This includes seeking compensation for both economic losses (such as medical expenses) and lost wages and non-economic damages (such as pain and suffering). With full tort, there are no limits as far as how much damage a policyholder must incur before they sue for pain and suffering, meaning they can take legal action for even an inconsequential injury.

While full tort offers broader protection, it usually comes with higher insurance premiums. We consider full tort coverage a critical investment, as it ensures they have access to full compensation if they’re injured in an accident. This option is especially helpful for those who want to pursue comprehensive legal remedies after an accident.

What Is Limited Tort?

Like full tort, limited tort is an option offered in auto insurance policies in some states. Unlike full tort, limited tort in Pennsylvania restricts a policyholder’s ability to sue for non-economic damages, like pain and suffering, after a car accident.

Under limited tort, you can typically recover compensation for measurable economic losses, such as medical bills and lost wages. However, your ability to seek compensation for subjective damages is limited.

That said, there are exceptions to this rule. If your injuries are deemed to be a “serious impairment of a body function,” you may still pursue non-economic damages despite having limited tort. Additionally, if the at-fault driver is convicted of DUI (or accepts ARD for such), is driving without insurance, or is engaged in certain other illegal activities, these limits may not apply.

People who choose limited tort do so because it offers lower insurance premiums compared to full tort. However, the trade-off of limited tort is a potential limitation on your legal rights after an accident.

Is Limited Tort the Same as Full Coverage?

The term “full coverage” typically refers to a combination of liability, collision, and comprehensive insurance. This combination protects against various types of damage to your vehicle and liability for injuries or property damage caused to others.

Limited tort is not the same as full coverage (although it can be part of an auto insurance policy). Instead, limited tort refers specifically to your rights to recover certain types of damages after a car accident. Don’t trust the phrase “full coverage.”

It’s possible to have limited tort within a full-coverage policy, but the two concepts address different parts of auto insurance. Limited tort affects your legal rights, while full coverage deals with the types of protection provided by your insurance.

- If you have questions about what your car insurance policy actually says, our Pennsylvania car accident attorneys would love to review your declaration sheet — for free! Reach out to Cohen, Feeley, Altemose & Rambo for a declaration sheet explanation!

What Is the Difference Between Limited Tort and Full Tort?

The main difference between full vs limited tort lies in the scope of your legal rights to seek compensation after a car accident, particularly for non-economic damages like pain and suffering.

- Limited tort restricts your ability to recover non-economic damages unless your injuries meet a specific legal threshold. While you can still recover economic damages like medical expenses and lost wages, your right to compensation for pain, emotional distress, and other subjective losses is limited or eliminated entirely.

- Full tort preserves your unrestricted right to seek compensation for both economic and non-economic damages. With full tort, you can sue for pain and suffering even in cases involving minor injuries caused by another party’s negligence.

Can You Sue in PA With Limited Tort?

Yes, you can sue in Pennsylvania with limited tort, but there is a limit on the types of damages you can pursue.

Limited tort allows you to seek compensation for economic damages. These include:

- Medical bills

- Lost wages

Limited tort limits your ability to recover non-economic damages unless specific exceptions apply.

Do You Have Economic or Non-Economic Damages?

To determine if you have economic or non-economic damages, start by examining the nature of your losses after an accident. Economic damages are tangible and measurable financial losses.

These can include the following:

- Medical bills

- Lost wages

- Rehabilitation costs

These damages can usually be calculated using solid data like receipts, pay stubs, and repair estimates.

Non-economic damages are harder to quantify. They include things like pain and suffering, emotional distress, loss of enjoyment of life, and loss of companionship. Assigning a value to these damages can be tricky: It usually involves estimating how the injury has affected your daily life, mental health, and overall well-being.

Talking with a personal injury attorney can help clarify which type of damages you may qualify for. They can review your case, gather evidence, and help you pursue appropriate compensation based on the impact of the accident.

What Are the Exceptions to Limited Tort in Pennsylvania?

Each state has its own unique legal landscape. In Pennsylvania, there are some exceptions that allow victims to pursue non-economic damages even if they don’t have full tort coverage.

- Impaired Driver: If the at-fault driver was under the influence of drugs or alcohol at the time of the accident and is convicted of DUI (or accepts ARD for it), limited tort restrictions are lifted.

- Uninsured Driver: If the negligent driver lacked proper insurance, the injured party can seek non-economic damages despite their limited tort status.

- Out-of-State Registration: When an at-fault vehicle is registered in another state, the driver’s insurance policy and legal obligations are subject to the laws of their home state. These may not align with Pennsylvania’s auto insurance limited tort restrictions.

- Non-Private Passenger Vehicle: If you were not operating a private passenger motor vehicle at the time of the accident, limited tort restrictions don’t apply.

- Pedestrians or Cyclists: Limited tort doesn’t apply to pedestrians, motorcyclists, or bicyclists injured in a motor vehicle accident. (A motorcycle isn’t classified as a private passenger motor vehicle.)

- Design, Manufacturing, Repair, or Maintenance Errors: If a vehicle defect or faulty repair caused the crash, limited tort restrictions don’t apply.

- Serious Injury: Severe injuries that greatly affect a person’s quality of life meet the legal threshold to recover non-economic damages. Death, a serious impairment of a body function, and permanent serious disfigurement are exceptions to limited tort.

What Is a Serious Injury in Pennsylvania?

To qualify as serious, an injury must meet specific legal criteria that demonstrate significant physical or mental impairment.

Examples of serious injuries include:

- Permanent Serious Disfigurement: Injuries that result in noticeable and lasting changes to the appearance, such as severe burns or scars.

- Serious Impairment of a Bodily Function: This might involve loss of the use of a limb, organ damage, or the inability to perform everyday tasks such as walking, speaking, or lifting. Surgery is often but not always required.

- Death: Any injury resulting in death qualifies as serious.

For an injury to be considered serious under Pennsylvania law, it must meet these conditions and result in a long-term or permanent impact on the injured person’s quality of life. The determination of seriousness can involve a legal evaluation by a judge or jury, which considers the physical and emotional consequences of the injury.

What Is Better, Full Tort or Limited Tort?

Whether you choose limited vs full tort depends on your financial priorities and risk tolerance. For instance, limited tort is typically cheaper per month because it typically lowers insurance premiums.

The downside of limited tort is that you can’t always rely on the exceptions to the policy. Even if they do occur, you still have to prove the injury meets the “serious” threshold.

Whether an injury qualifies under these exceptions might be decided by a jury, which means you aren’t guaranteed a favorable outcome. Even if you’re injured, a jury might not decide that your injury is serious enough to lift the limited tort restrictions. This could potentially leave you without full compensation for pain and suffering.

Due to these uncertainties and the rare nature of some exceptions, we strongly recommend full tort coverage. While it does come with higher premiums, it offers peace of mind knowing you can fully recover damages regardless of how or why the accident occurred.

Should I Get Full Tort in PA?

Getting full tort in Pennsylvania is often a wise choice if you want the most comprehensive protection. It allows you to fully recover all types of damages, including pain and suffering, regardless of the circumstances of the accident.

While full tort comes with higher premiums, it provides peace of mind and eliminates the need to rely on rare exceptions to limited tort. If you want the most flexibility and security in pursuing compensation after an accident, full tort is the better option.

What Is Stacked vs. Unstacked Insurance?

In Pennsylvania, stacked and unstacked insurance refers to the way uninsured or underinsured motorist (UM or UIM) coverage is applied across multiple vehicles on your policy or across multiple policies. This type of coverage provides financial protection if you’re in an accident caused by a driver who has little or no insurance.

Unstacked insurance limits your UM or UIM coverage to the amount specified for a single vehicle. For example, if you have $50,000 in UM or UIM coverage for one car, that is the maximum amount you can recover, even if you have other vehicles insured under the same policy.

Stacked insurance, on the other hand, combines the UM or UIM coverage limits of all vehicles on your policy — or even across policies you own. For instance, if you have three vehicles, each with $50,000 in UM or UIM coverage, stacking allows you to combine the coverage, providing a total of $150,000 in protection if you were to get in an accident.

Stacked insurance offers significantly greater financial security. While the higher amount of protection may not come close to the value of a loved one’s life or a permanent loss of mobility, it can help ease the financial burden so you can focus on the things that matter most.

Additionally, on average, adding stacked insurance raises premiums by only 10 to 12%, depending on the number of vehicles covered and the insurer. This is usually not a large increase to a monthly premium.

Do I Need Stacked Uninsured Motorist Coverage in PA?

Stacked uninsured motorist coverage can be invaluable in serious accidents involving uninsured or underinsured drivers. This added protection is especially helpful if you have severe or permanent injuries that require expensive medical treatments or mean you have to take time away from work.

Considering how affordable stacked insurance is compared to the amount of extra coverage it provides, it’s generally a smart choice when it comes to safeguarding your financial security. Financial benefits aside, it also provides peace of mind to know you’re prepared for even the most unexpected situations. If you can afford it, stacked UM coverage is generally recommended.

Uninsured vs. Underinsured Motorist Coverage

Uninsured motorist and underinsured motorist coverage protect drivers in accidents caused by others who don’t have enough insurance. Both types of coverage are essential for financial security on the road.

- UM coverage applies when the at-fault driver has no insurance. For example, if you’re hit by an uninsured driver, UM coverage pays for your medical bills, lost wages, bodily injury, and other damages up to your policy limits.

- UIM coverage applies when the at-fault driver has insurance, but their coverage limits are too low to fully cover your damages. For instance, if your damages total $100,000 but the other driver’s policy only covers $25,000, UIM coverage can make up the $75,000 difference, depending on your policy.

This is important because in cases where a driver’s insurance isn’t enough to cover your expenses, it’s very difficult to go after assets, even if you employ the best car accident lawyers in Bethlehem.

Realistically, it’s generally best to depend on your UM/UIM coverage and the coverage of the at-fault driver’s insurance. Even though this insurance is optional, it is a smart investment in your financial protection. You can’t control what kind of coverage the other driver is going to have.

What Are the Exclusions for UM/UIM Insurance?

In Pennsylvania, UM/UIM insurance may include several exclusions that limit when coverage applies. Common exclusions include injuries sustained while committing illegal acts, such as driving under the influence, and injuries caused during intentional acts, like road rage incidents.

Another exclusion, the “regular use” exclusion, previously denied coverage if the insured was injured while driving a non-owned vehicle they used regularly, such as a company car.

The household or family car exclusion may deny coverage when a family member or you are operating another car from your same household that is not insured on the policy that you are pursuing.

Get a Free, Clear Explanation of Your Car Insurance

Car insurance can be difficult to navigate, especially when you need to balance proper financial protection with affordability. While full tort coverage may be more expensive, it is critical for those who would like to pursue legal action for non-serious injuries.

If you’re not sure what type of tort insurance you have or you would like a clear breakdown of your auto insurance policy, contact us today. Our attorneys at Cohen, Feeley, Altemose & Rambo are familiar with different types of policies and can help you navigate your insurance coverage.

If you have already been in a car accident, you may be able to recover some of your expenses. Our attorneys have a track record of success and would be happy to schedule a free consultation to see how we can help you during your recovery.

Sources:

What Is Full Coverage Car Insurance? | Investopedia

Ending the Confusion: Economic, Non-Economic, and Punitive Damages | ACS

Pain and suffering | Legal Information Institute

Automobile Insurance Guide | Pennsylvania Insurance Department