Whose Insurance Pays in a Multi-Car Accident?

If you’ve been in a multiple-vehicle accident, there are likely quite a few questions that come to mind. For instance, you may be wondering what to do first, what types of evidence to start gathering for your case, and when to contact a personal injury lawyer.

As things calm down, you might ask questions, like “Whose insurance will be paying for this?” Read on to learn everything you need to know about insurance and multi-car accidents.

Common Causes of Multiple-Vehicle Collisions

Multi-car accidents, often called pile-ups, are typically caused by a chain reaction of sorts. When you get to the root of it, the most common causes include tailgating, distracted driving, speeding, and bad weather conditions like rain, snow, or fog. These weather conditions are known for reducing visibility and road traction. In some cases, these accidents can also be caused by drunk driving.

Poorly executed lane changes, sudden braking, or failure to maintain a safe following distance are often the second elements in the chain of events. Unfortunately, too many cars too close together means that a single mistake can lead to multi-car incidents.

Construction zones and high-traffic areas are especially prone to these incidents. Luckily, you can help prevent these accidents by staying alert, reducing speed, and increasing following distance in challenging conditions.

How Is Fault Determined in a Multiple Vehicle Accident?

Before answering whose insurance pays in a multi car accident, first, we must determine fault. Determining fault in a multiple-car accident is not often immediately clear; investigations are usually required. Police reports, witness statements, and dashcam footage can all be important when it comes to identifying possible causes.

Fault may be divided among multiple parties based on their actions leading up to the collision. Accident reconstruction experts commonly analyze the sequence of impacts, skid marks, and vehicle damage to help establish responsibility.

Insurance adjusters (and courts in the event of a trial) also evaluate whether drivers violated traffic laws by speeding or following too closely. In some cases, comparative negligence laws may apply, which can reduce each victim’s compensation depending on their percentage of responsibility. Naturally, this can also affect whose insurance pays in a multi-car accident.

- 51% Bar Rule: Pennsylvania has modified comparative negligence, meaning victims can recover compensation if they’re deemed less than 51% responsible.

Who Is Responsible in a Multi Car Rear-End Accident?

Responsibility in a multi-car rear-end accident depends on all of the incidents involved. The driver at the back is typically the most at fault, as they likely failed to maintain a safe following distance.

However, the blame may shift if another driver causes a sudden, unexpected stop or makes an unsafe lane change. Middle drivers may also be more at fault if they hit the car ahead of them before being struck from behind.

What Car Accident Damages Can You Recover?

Victims of car accidents can typically recover both economic and non-economic damages.

- Economic damages cover monetary losses, such as medical expenses, property damage, lost wages, and future earning potential.

- Non-economic damages address losses that are harder to define, like pain and suffering, emotional distress, and loss of enjoyment of life.

- In some cases, punitive damages may be awarded if the at-fault driver’s actions were reckless or intentional. Punitive damages are essentially a punishment — they’re there to motivate the at-fault driver to drive more safely in the future.

To ensure fair compensation for your trouble, try to document any injuries, repair estimates, and other losses you might have. Legal representation can also help maximize your ability to recover your losses, especially in cases involving multiple parties or disputed liability.

What Happens if the At-Fault Driver Doesn’t Have Enough Coverage?

So, what if you have $20,000 in damages, but the at-fault driver’s insurance coverage only pays out $15,000? If the at-fault driver’s insurance coverage isn’t enough to cover all your damages, uninsured/underinsured motorist (UM/UIM) coverage can help bridge the gap.

UM/UIM insurance is designed to protect you when the at-fault driver either has no insurance or their policy limits are too low to fully cover your losses. This coverage can pay for medical expenses, lost wages, pain and suffering, and other damages up to the limits of your UM/UIM policy. This can also help if the driver is unlicensed.

Without UM/UIM coverage, you may need to try to get compensation from the at-fault driver directly. This won’t work if they don’t have enough assets to cover the amount you need. It is also impractical to do in most cases.

UM/UIM coverage can help make sure you aren’t left with financial burdens from someone else’s negligence. Working with underinsured and uninsured motorist coverage attorneys is especially important. They understand the details of this field and can help you figure out the best way to recover your losses.

Full Tort vs. Limited Tort in Multiple Vehicle Accidents

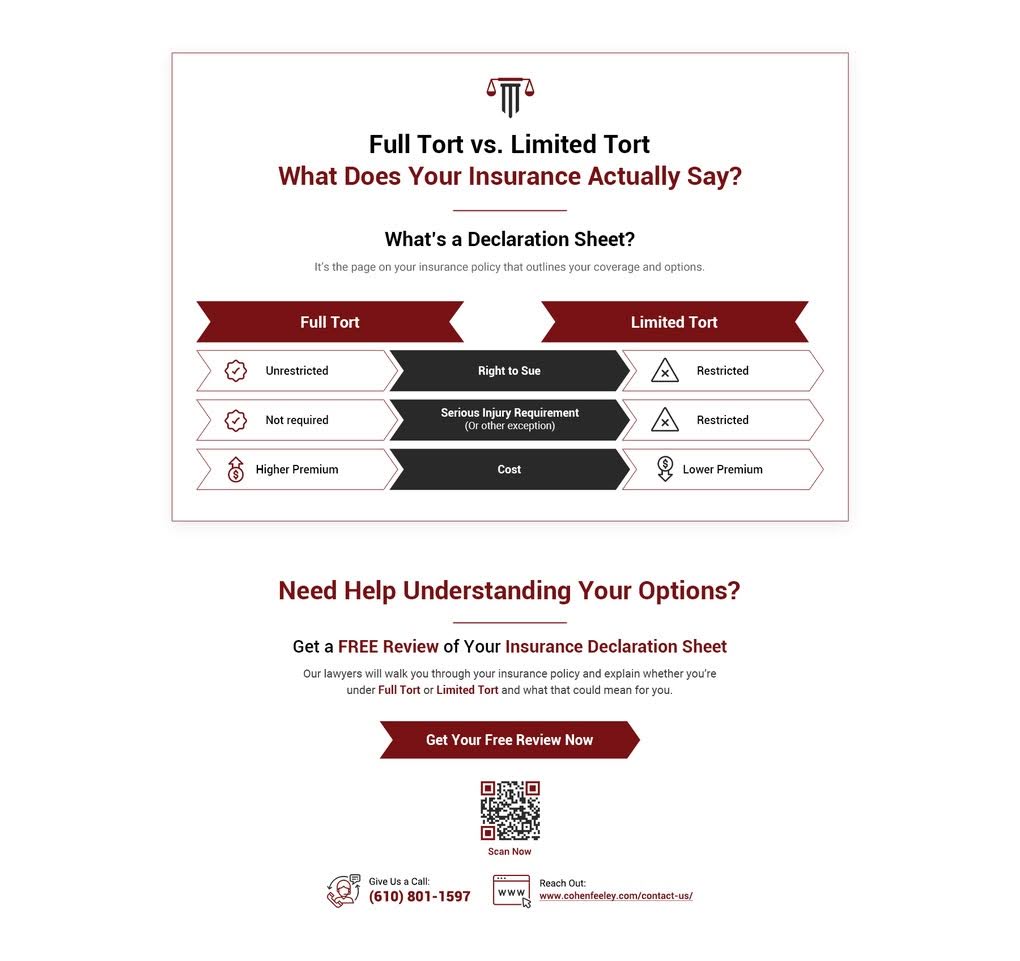

In states with tort insurance systems (like Pennsylvania), you can generally choose to opt for full tort or limited tort coverage. Full tort allows you to sue for all damages after an accident, including pain and suffering, no matter how severe they are.

Limited tort, on the other hand, is cheaper but restricts your ability to recover non-economic damages unless the injuries are severe. This is mostly applicable in cases of permanent disfigurement or death. In a multiple-vehicle collision, having full tort coverage can help give you more options when it comes to seeking compensation.

How To File a Personal Injury Claim After a Multi-Car Accident

One of the first steps toward finding out whose insurance pays in a multi-car accident and receiving just compensation is filing a personal injury claim.

Here’s a general overview of what the process looks like.

Step 1: Seek Medical Attention

Your health should be your top priority after an accident. Get checked by a doctor, even if you feel fine — some injuries may not show symptoms immediately. Medical records are also great pieces of evidence you may be able to use to support your claim.

Step 2: Gather Evidence

Take photos of the accident scene, vehicle damage, and any visible injuries. Collect contact information from other drivers and witnesses. Next, request a copy of the police report so you have an official record of the incident.

Step 3: Notify Your Insurance Company

Report the accident to your insurance company as soon as possible. Provide them with basic details, but try not to make statements about fault. Stick to the facts until you consult with an attorney.

Step 4: Consult a Personal Injury Attorney

A lawyer can help you navigate the claims process, especially complex multi-car accidents. A car accident lawyer can handle negotiations with insurance companies and make sure your rights are protected. They can also help you fight for compensation so that you can recover without worrying about medical bills or lost wages.

Step 5: File the Claim

Your attorney can help you file the necessary paperwork with the at-fault party’s insurer. Include evidence, medical records, and an estimate of your damages to support your claim.

Step 6: Negotiate or Litigate

Insurance companies may offer a settlement, but it might not cover all your losses. In these cases, your attorney can negotiate for a fair amount or take your case to court if necessary.

Filing a Personal Injury Claim: What To Know

Should I accept the first compensation offer?

It’s usually not a good idea to accept the first compensation offer from an insurance company. These initial offers are often low and might not fully cover your damages. Take some time to evaluate the offer and your injuries with the help of an attorney, who can help you receive a fair settlement based on the extent of your injuries and losses.

How do you respond to a low insurance settlement offer?

Responding to a low settlement offer requires you to remain calm and professional. Present the evidence you have, like medical bills and repair estimates, to support your counteroffer. An attorney can also negotiate on your behalf.

What happens when you reject an insurance settlement offer?

If you reject an insurance settlement offer, negotiations typically continue. The insurance company may respond with a higher offer. If you cannot reach an agreement, you can escalate the case by filing a lawsuit to seek compensation through the courts.

Do insurance companies want to settle quickly?

Yes, insurance companies often aim to settle insurance claims quickly to keep their costs down. However, quick settlements may not always be enough to cover all your damages, especially if you’re still getting medical treatment. Be careful and consult with an attorney before accepting an offer.

Frequently Asked Questions After a Multi Car Accident

Who pays my medical bills after a multi-car accident?

Pennsylvania insurance contains no-fault coverages, and medical coverage is one of them. Regardless of who bears fault for the accident, your own auto insurance medical coverage will cover your medical treatment for injuries from the accident. This is to ensure that you can afford to get medical treatment fast.

Who is at fault in a 4-car rear-end collision in Pennsylvania?

In a 4-car rear-end collision, the fault is typically assigned to the driver whose negligence initially caused the chain reaction. Pennsylvania follows a comparative negligence rule, so in this state, fault can be shared among drivers based on how they contributed to the accident.

Who is at fault in a rear-end collision involving three cars?

Fault in a 3-car pile-up depends on how the crashes occurred. Usually, the driver at the back is responsible for hitting the car in front, but middle drivers can also share blame if their actions contributed to the accident. These cases can be complex and that complexity translates to whose insurance pays in a car accident — retaining legal counsel here is a smart idea.

Does collision insurance cover both cars?

Collision insurance is an optional, no-fault coverage that covers damage to your vehicle, regardless of who caused the accident. It doesn’t cover damage to the other driver’s car (that’s typically handled by the at-fault driver’s liability insurance).

Whose insurance do you call when rear-ended?

One of the first things to do if you’ve been rear-ended is notify your own insurance company, even if the other driver is at fault. Your insurer can guide you through the claims process and may even work with the at-fault driver’s insurance to recover damages.

Cohen, Feeley, Altemose & Rambo Can Help You Recover Compensation

At Cohen, Feeley, Altemose & Rambo, we know that any car accident can be overwhelming to navigate, let alone a multi-car pile-up. These accidents can be incredibly dangerous, and pursuing compensation typically isn’t a first thought when you’re juggling doctor’s visits, physical therapy, and other specialist appointments.

When you’ve been in a car accident, don’t try to navigate the aftermath alone. Instead, consult one of our experienced car accident attorneys. We focus on recovering compensation while you focus on recovering. Contact us today to schedule a free consultation.